In the world of financial scams and fraudulent schemes, pyramid schemes have gained notoriety for their deceptive practices and the devastating impact they can have on individuals’ lives. Pyramid scheme fraud has lured countless people into a web of false promises and financial ruin, leaving them trapped in a cycle of deception.

This article aims to shed light on how people can unknowingly fall into the trap of fraudulent pyramid schemes and provide valuable insights to help individuals protect themselves from becoming victims. By understanding the inner workings of pyramid schemes and the tactics employed by scammers, readers can empower themselves with knowledge to make informed decisions and safeguard their financial well-being.

In this article your learn what is Pyramid Scheme fraud and how people fall into fraudulent pyramid schemes. Then with this information you’ll be well equipped to help you, your family, friends and colleagues to avoid pyramid schemes.

Read more: Pyramid Scheme Fraud: How People Fall Into Fraudulent Pyramid Schemes

Summary: 10 facts about Pyramid Scheme Fraud

- Pyramid schemes are fraudulent business models that promise high returns and financial success through recruitment and investment.

- These schemes operate by recruiting new participants who must make an initial payment or investment and then recruit others to do the same.

- The primary source of income in pyramid schemes is derived from the recruitment of new members rather than the sale of actual products or services.

- Pyramid schemes often use persuasive tactics, such as promising quick and substantial profits, to entice individuals into joining.

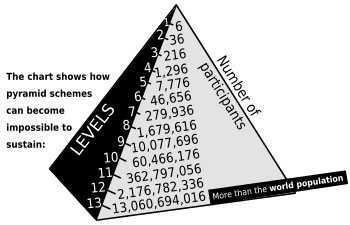

- The structure of pyramid schemes is unsustainable, as they rely on an ever-increasing number of new recruits to sustain the financial payouts.

- Many people fall into pyramid scheme fraud due to the allure of easy money and the promise of financial independence.

- Participants may initially see some returns, but the majority of individuals involved in pyramid schemes end up losing their investments.

- Pyramid schemes are considered deceptive and fraudulent practices, so many countries have made them illegal.

- Common signs of pyramid schemes include a heavy emphasis on recruitment, lack of a genuine product or service, and a hierarchical structure.

- To protect themselves from falling into pyramid scheme fraud, individuals should exercise caution, thoroughly research any investment opportunity, and be skeptical of unrealistic promises of financial gains.

Understanding Pyramid Schemes

Understanding Pyramid Schemes is crucial in order to protect oneself from falling victim to Fraudulent Pyramid Schemes. Why are pyramid schemes illegal? Pyramid schemes are deceptive and illegal business models that promise participants high returns on their investments. The basic structure of a pyramid scheme involves recruiting new participants who contribute money or investments, with the promise of earning profits through recruitment and the subsequent recruitment of others. However, the sustainability of pyramid schemes relies solely on the continuous recruitment of new participants, making them inherently flawed and destined to collapse.

One key aspect in understanding pyramid schemes is differentiating them from legitimate business models. While legitimate businesses generate profits through the sale of products or services, pyramid schemes primarily focus on recruitment and the collection of fees from new participants. This fundamental difference makes pyramid schemes unsustainable in the long run and ultimately results in financial losses for the majority of participants. See the heading below where I cover how to spot scams as pyramid schemes are not the only ones to avoid.

In conclusion, understanding the nature of pyramid schemes is essential to avoid falling victim to Fraudulent Pyramid Schemes. By being aware of their deceptive characteristics, differentiating them from legitimate business models, recognizing the psychological manipulation involved, and understanding the unsustainability of their structure, individuals can make informed decisions and protect themselves from financial losses and other negative consequences associated with pyramid schemes.

How to Spot Scams and Ways to Avoid Work From Home Scams Online

I have reviewed several hundred products and courses offering people to make money online. So I have substantial experience in understanding and detecting more subtle ways that these promoters entice people. Click on this article for solid tips to avoid these plus tips to spot scams.

The Psychology Behind Falling into Pyramid Scheme Fraud

Falling into Pyramid Scheme Fraud is often influenced by psychological factors that exploit individuals’ desires for financial success and personal growth. Here are some key psychological aspects:

- Appeal of easy money: Fraudsters capitalize on people’s dreams of financial freedom and manipulate their emotions to convince them to participate in pyramid schemes by promising quick and easy returns.

- Power of social influence: People are more likely to join pyramid schemes if they see others around them succeeding or if they feel pressured by friends, family, or acquaintances who are already involved. This creates a sense of FOMO (Fear of Missing Out) and the belief that they too can achieve the same level of success.

- Sense of belonging and community: Fraudsters often create a tight-knit and supportive environment within their schemes, fostering a sense of camaraderie and belonging. This can make individuals feel valued and important, enhancing their motivation to participate and recruit others.

- Cognitive biases: Biases such as the “illusion of control” and the “optimism bias” can lead individuals to overlook the inherent flaws and risks of pyramid schemes. They may believe they have more control over the outcome or underestimate the likelihood of failure, leading them to disregard warning signs and invest their time and money into fraudulent schemes.

Understanding the psychology behind falling into pyramid scheme fraud is crucial in developing awareness and resistance to such schemes. By recognizing these psychological tactics, being cautious of social influence, and critically evaluating promises made, individuals can protect themselves and make informed decisions to avoid becoming victims of pyramid scheme fraud.

Tactics Used in Pyramid Scheme Fraud

Pyramid scheme fraud relies on deceptive tactics to lure unsuspecting individuals into participating in fraudulent schemes. Understanding these tactics is essential in identifying and avoiding such scams. Here are three common tactics used in pyramid scheme fraud.

False Promises of High Returns

Pyramid scheme operators entice potential victims with promises of astronomical profits in a short period. They claim that participants can earn significant returns on their investments or through the recruitment of others. However, these promises are unrealistic and unsustainable, as pyramid schemes rely solely on the continuous recruitment of new participants to generate revenue.

Pressure to Recruit Others

Pyramid schemes heavily emphasize recruitment as a means to earn profits. Participants are coerced into recruiting their friends, family, and acquaintances, often using high-pressure tactics. This creates a cycle of constant recruitment, as each new recruit is expected to bring in more participants. The pressure to recruit is driven by the pyramid structure, where only those at the top benefit while the majority of participants at the bottom suffer financial losses.

Lack of Genuine Products or Services

Unlike legitimate multi-level marketing (MLM) companies, pyramid schemes typically lack genuine products or services. The focus is primarily on recruiting new members rather than selling actual products. Any products or services offered are often of poor quality or overpriced, serving as a mere disguise for the underlying pyramid structure. The absence of a sustainable business model based on genuine products or services is a red flag indicating pyramid scheme fraud.

By being aware of these tactics, individuals can protect themselves from falling victim to pyramid scheme fraud. It is crucial to exercise caution, conduct thorough research, and seek advice from trusted financial professionals before investing in any opportunity. Remember, if an offer seems too good to be true, it likely is, and it is better to err on the side of caution to safeguard your financial well-being.

Consequences of Involvement in Pyramid Schemes

Involvement in pyramid schemes can lead to dire consequences for individuals who become entangled in these fraudulent schemes. One of the most significant repercussions is financial loss, as participants often end up losing their entire investment with little to no chance of recovering their money.

Moreover, pyramid schemes are illegal in many jurisdictions, and those involved may face legal repercussions, including fines and even imprisonment. The damage caused by pyramid schemes is not only limited to finances and legal matters; it can also strain personal relationships and trust. Friends and family members who have been recruited into the scheme may feel betrayed and may even sever ties with the participant.

Furthermore, the emotional toll of being involved in a pyramid scheme can be substantial. Participants may experience feelings of shame, regret, and guilt, as they realize they have been caught up in a fraudulent activity that has harmed themselves and others. The stress and anxiety resulting from the financial and personal consequences of pyramid schemes can have a significant impact on an individual’s overall well-being and mental health.

It is crucial to be aware of the potential consequences of involvement in pyramid schemes and to avoid participating in such schemes to protect oneself and others from harm.

Protecting Yourself from Pyramid Scheme Fraud

Protecting yourself from pyramid scheme scams doesn’t have to be difficult. However, several important measures should be observed here:

- Educate yourself: Learn about the characteristics and warning signs of pyramid schemes. Understand how they differ from legitimate business opportunities. Familiarize yourself with common tactics used by fraudsters.

- Research before investing: Thoroughly investigate any business opportunity before committing your time or money. Verify the credentials, licenses, and reputation of the company or organization offering the opportunity. Look for independent reviews and feedback from reliable sources.

- Read and understand agreements: Carefully review any contracts or agreements before signing them. Pay attention to clauses that require recruiting others or making significant upfront payments. Seek legal advice if necessary to ensure you fully comprehend the terms and potential risks.

- Trust your instincts: If an opportunity sounds too good to be true or involves high-pressure sales tactics, approach it with skepticism. Listen to your gut feelings and be cautious of promises of quick and guaranteed returns. Seek advice from trusted professionals or consult with friends and family before making any financial decisions.

- Stay informed: Stay updated on the latest news and information about pyramid schemes and fraudulent activities. Follow reputable sources and organizations that provide guidance on consumer protection and financial fraud prevention.

By following these precautions and being proactive in protecting yourself, you can minimize the risk of falling into pyramid scheme fraud and safeguard your financial well-being.

Pyramid Scheme Fraud – How People Fall into Fraudulent Pyramid Schemes – How to Avoid Pyramid Schemes

In conclusion, pyramid scheme fraud continues to be a significant threat, luring unsuspecting individuals with false promises of easy money and financial success. People often fall into these schemes due to a lack of awareness, vulnerability, and the allure of quick riches. The psychological tactics employed by fraudsters prey on individuals’ desires for financial security and independence.

Understanding the tactics used in pyramid schemes, recognizing warning signs, and being aware of the consequences are crucial for protecting oneself from falling victim to fraud. By educating ourselves, conducting thorough research, and trusting our instincts, we can mitigate the risks associated with pyramid scheme fraud.

It is important to remember that legitimate business opportunities are based on the sale of genuine products or services, not the recruitment of others. By staying informed, seeking advice from trusted sources, and making informed decisions, we can safeguard our financial well-being and avoid the devastating consequences of involvement in fraudulent pyramid schemes.

Overall, combating pyramid scheme fraud requires a collective effort, including education, awareness campaigns, and stringent legal measures. By raising awareness and empowering individuals with knowledge, we can create a safer environment and protect ourselves and others from falling into the trap of pyramid scheme fraud.

FAQ

What is a pyramid scheme and how do pyramid schemes work?

A pyramid scheme is a fraudulent business model that promises high returns based on recruiting others into the scheme. The scheme operates by recruiting participants who are required to make a financial investment. These participants are then encouraged to recruit others, with the promise of earning a percentage of their recruits’ investments. The structure of the scheme resembles a pyramid, where the initial participants are at the top and the newer recruits form the lower levels. As the scheme grows, it becomes unsustainable, and eventually collapses, leaving the majority of participants with financial losses.

How do people get involved in pyramid schemes?

People often get involved in pyramid schemes through persuasive recruitment tactics. They may be approached by friends, family members, or acquaintances who present the scheme as a lucrative investment opportunity. Participants are enticed by the promise of high returns and the potential to earn passive income. Additionally, the schemes often rely on emotional manipulation, exploiting individuals’ desires for financial freedom and a better future. Many people join pyramid schemes without fully understanding the illegal nature of the business model or the risks involved.

What are the warning signs of a pyramid scheme?

There are several warning signs that can help identify a pyramid scheme. One major red flag is the emphasis on recruitment rather than the sale of genuine products or services. Pyramid schemes often require participants to purchase inventory or pay membership fees without offering any real value. Another warning sign is the promise of high returns with little to no effort. Legitimate investments involve risk and require time and effort to generate returns. Lastly, if the compensation structure heavily relies on recruiting others and earning commissions from their investments, it is likely a pyramid scheme.

How can individuals protect themselves from pyramid scheme fraud?

To protect themselves from pyramid scheme fraud, individuals should educate themselves about the characteristics and warning signs of these schemes. They should be wary of any investment opportunity that promises high returns with little risk or effort. It is important to research and verify the legitimacy of the company or investment opportunity before getting involved. Consulting with financial advisors or professionals can also provide valuable guidance. Additionally, individuals should be cautious of pressure to recruit others and should avoid participating in schemes that focus primarily on recruitment. By being vigilant and informed, individuals can safeguard themselves from falling into fraudulent pyramid schemes.

Here’s How I Earn A Passive Income Online….

Earning a passive income was not an easy journey. It’s not all sunshine and rainbows, it requires consistent committed efforts initially. I had to put in daily effort to make things work which shows serious I am about earning through this online business.

Investing in yourself through expanding your knowledge with the best online education is just a start. Yes, it involves money. I have invested not only my time but also money to get things started. This is with the training and mentoring community I recommend over all others to learn affiliate marketing and other online business models.

Through affiliate marketing, I have found the right passive income for me. I create articles or blogs which using easy to learn SEO that create free traffic.

The best thing about this is it won’t cost money to generate this free traffic! By creating quality content to help people get enlightened about different topics, Google and the search engines will rank your helpful content. This gives you free traffic!

This strategy is not only for people to earn money but also to know how to make quality content. This is such a POWERFUL technique for marketers.

You can give my top-rated course a FREE test drive before you buy it (with just a $49 Premium subscription), which is one of its many great benefits. You can check out the first five lessons of the program, the awesome community, and even create one free website for free first to see if it suits your style.

To sum up, I think this is the best affiliate marketing training out there. And if you’re trying to find something related, just hit the link below!

Hi John,

I think it’s unfortunate to see how pyramid schemes can exploit psychological factors to lure people in. I appreciate the tips on how to protect oneself from these schemes.

I’m curious- Could you share more about the legal measures being taken to combat pyramid scheme fraud? Are there any specific ones that you’re aware of?

Thank you for sharing- this article was very informative.

Thanks for your comments Eric.

For your questions, there are various legal measures to combat pyramid scheme fraud and these vary depending on the country or jurisdiction. Governments and regulatory bodies worldwide generally employ a combination of legislation, enforcement and education to address pyramid schemes and protect consumers.

Some common legal measures include:

1. Anti-Pyramid Scheme Laws – Many countries have specific laws that define pyramid schemes and prohibit their operation. These laws typically outline what constitutes a pyramid scheme, how it differs from legitimate multi-level marketing (MLM) or direct selling, and set penalties for those found guilty of running such schemes.

2. Consumer Protection Laws

3. Regulatory Agencies e.g. Federal Trade Commission (FTC), Competition and Markets Authority (CMA) in the UK, Australian Competition and Consumer Commission, Securities and Exchange Commission (SEC). In recent years, the SEC had been responding aggressively against MLM-based pyramid schemes by filing emergency actions designed to shut down the frauds, freeze ill-gotten assets, bring the perpetrators to justice, and ultimately return money to harmed investors.

4. Educational Campaigns e.g. SEC’s Pyramid Scheme Task Force

5. Financial Regulation. Financial authorities may also be involved as pyramid schemes often involve monetary transactions.

6. Whistleblower Protection. Some jurisdictions have laws that protect individuals who come forward with information about pyramid schemes.

Thanks for your great question and I hope this helps. Please contact me if you need further information either commenting here or on [email protected]